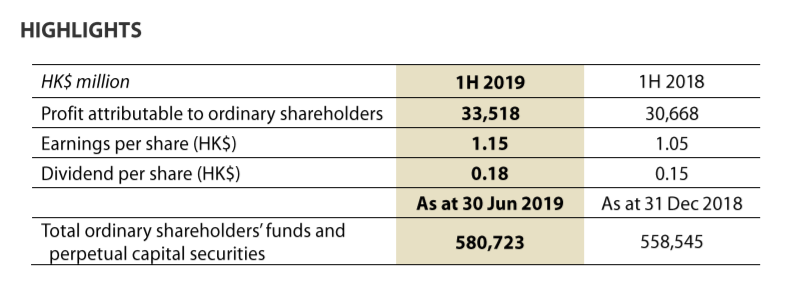

CITIC Limited (“the company”) today announced its half-year results for the period ended 30 June 2019.

For the first six months of 2019, CITIC Limited recorded a profit attributable to ordinary shareholders of HK$33.5 billion, up 9% compared with the same period last year. The growth in earnings was primarily driven by the solid performance of CITIC Bank and special steel business, as well as the first profit recorded at Sino Iron.

The board recommends an interim dividend payment of HK$0.18 per share, HK$0.03 more than the same period last year.

Financial Services achieved a profit of HK$25.5 billion, an increase of 5% from the same period last year with the biggest rise coming from CITIC Bank. The bank’s strong performance resulted from the growth in both interest and non-interest income. Benefiting from the credit easing in China in the first half of 2019, net interest income increased 15% year-on-year as assets grew and net interest margin improved. Non-interest income, which was 38.7% of total revenue, increased 14% year-on-year. CITIC Trust’s profit grew 35%, driven by its proprietary business. CITIC-Prudential Life’s net profit was flat, as a provision was made on an investment offsetting the solid growth in premiums. CITIC Securities outperformed its peers and recorded a 16% higher profit than the first half of last year.

Resources and Energy delivered a profit of HK$2.09 billion, a year-on-year increase of 64%. This was primarily due to profit achieved at Sino Iron as a result of higher iron ore prices and an ongoing cost reduction programme. The profit of CITIC Resources, on the other hand, experienced a reduction of 32% to HK$362 million, mainly due to the lower prices of oil, aluminium and coal. CITIC Metal’s profit declined by 24% to HK$587 million owing to reduced deliveries of copper ore caused by a road blockage in Peru. It increased its interest in Canadian company Ivanhoe Mine to 29.4% on 16 August 2019.

Manufacturing recorded a net profit of HK$3.5 billion, up 46% year-on-year. Special steel profit grew 61% to RMB2.8 billion, driven by higher sales volumes and an improved margin. Total sales volumes increased 18% year-on-year as four plants delivered solid performance. Affected by tariffs levied by the United States and a weakened worldwide automobile market, CITIC Dicastal’s profit decreased 16% to RMB504 million. In an effort to expand its production capability outside of China, CITIC Dicastal completed the first phase of its plant in Morocco and its US plant produced 23% more aluminium wheels during the period. CITIC Heavy Industries recorded a 50% surge in profit to RMB95 million, due to improvements in its heavy machinery and related businesses.

Engineering Contracting’s profit remained flat at HK$703 million, mainly contributed by municipal and national network security projects in Wuhan as well as the East-West Expressway in Algeria and investment gains. New projects signed during the period included twelve rice processing and storage facilities in ten provinces and cities in Cambodia and a number of sewage treatment projects in China.

Real Estate recorded a net profit of HK$3.5 billion, a year-on-year reduction of 25%. The profit was mainly attributable to the 10% interest in China Overseas Land and Investment, contribution from Lujiazui Harbour City in Shanghai, and the booking of profit from the KADOORIA luxury residential project in Hong Kong.

Other businesses’ continued to contribute towards the company’s bottom line. CITIC Press successfully listed on the ChiNext board of the Shenzhen Stock Exchange in July 2019.