CITIC Limited today announced its half-year results for the period ended 30 June 2023.

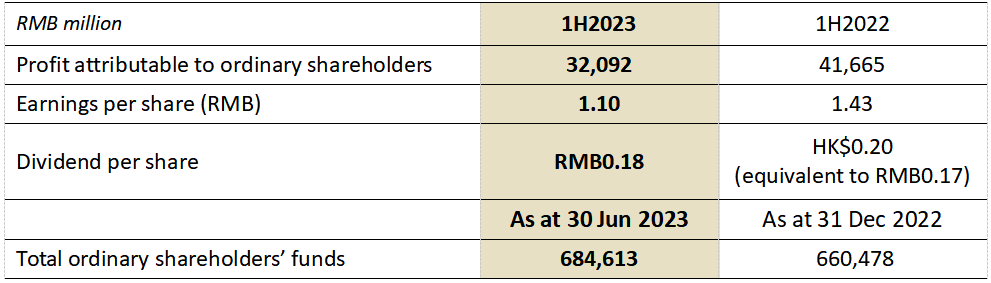

Despite a series of economic challenges both in China and globally, CITIC Limited achieved steady growth. The company recorded total revenue of RMB334 billion, a year-on-year increase of 2.8%. Profit attributable to ordinary shareholders was RMB32.1 billion, a year-on-year increase of 2.3% on a comparable basis excluding the one-off revaluation gain of CITIC Securities’ consolidated earnings of RMB10.3 billion in the same period last year.

The board recommends a dividend distribution of RMB0.18 per share, with a total dividend amount of RMB5.236 billion.

Building a strong foundation for comprehensive financial services

1.Developing major drivers for high-quality development: We have been making significant progress in our goal to become a top-tier financial holding company under the “One-Four-Three-Five” strategy. We have leveraged the advantage of having comprehensive financial licences to strengthen the core competence of our comprehensive financial services. We are supporting the development of our comprehensive financial services business by enhancing corporate governance, risk management, capital management and wealth management systems. We are building a top-tier digital platform to harness the potential of CITIC Financial Holdings and to lead industry-wide digitalisation with Chinese characteristics. Our optimised capital allocation with migration to lower risk-weighted assets resulted in a capital saving of RMB10.5 billion. Additionally, we successfully hosted the First Session of the CITIC Wealth Manager Conference, which gathered a significant number of asset management institutions to build a comprehensive wealth management ecosystem. The new “CITIC Fortune Plaza” was successfully launched as well.

2.Committed to serving the real economy: We are committed to consolidating our comprehensive financial services as a “ballast stone” and emphasising the very essence of finance. CITIC Bank achieved double-digit loan growth in key areas such as inclusive finance, medium-to-long-term financing for the manufacturing sector, green lending, strategic emerging industries and agricultural loans compared to the beginning of the year. ROA and ROE both recorded year-on-year improvement, while the non-performing loan ratio and non-performing loan balance decreased. CITIC Securities has increased its support for strategic emerging industries and is ranked first in both equity and bond underwriting value. China Securities has actively facilitated the development of specialised and sophisticated enterprises. It has maintained an industry-leading position in total sponsored listings and fundraising value on the Beijing Stock Exchange. CITIC Trust, closely aligned with the developmental needs of the real economy, has further accelerated its business transformation, surpassing RMB1.2 trillion in the scale of its innovative business, marking a major breakthrough. CITIC-Prudential Life has remained committed to implementing new regulations under the second phase of the China Risk-Oriented Solvency System. CITIC-Prudential Life has also optimised its business structure, resulting in growth in both new business value and margin. The number of customers served by CITIC Consumer Finance, which has been improving its consumer lending capabilities, has exceeded tens of millions. With a cumulative loan amount of RMB87 billion, it helps boost domestic consumption and stimulate domestic demand.

3.Building a strong line of defence against risks: Our ability to respond and address risks has been enhanced by the establishment of a comprehensive risk management system, which has strengthened the integration of compliance and internal controls and given us a thorough understanding of our risk profile. Our financial subsidiaries have shown improvements in reducing the balance and ratios of non-performing assets as well as the proportion of special-mention assets. The exploration and application of CITIC’s distinctive approach to promoting synergies among financial and non-financial sectors has yielded tangible results in risk mitigation. To help rebuild market confidence and foster social stability, and guided by the 16-point set of financial measures, CITIC has played a role in supporting key property developers to ensure the completion and delivery of projects.

Enhancing the value creation capability of non-financial subsidiaries

1.Consolidating our industry-leading advantage: CITIC Dicastal is conducting R&D on integrated chassis die-casting projects for automobiles, to reduce production costs and improve the strength of vehicle bodies. The initiative will contribute to the development of intelligent manufacturing in China’s automobile industry. CITIC Heavy Industries recorded rapid growth in orders from the offshore wind power sector, as part of the continuous expansion of its new business portfolio. CITIC Pacific Special Steel aims to become the world’s largest producer of seamless steel tubes. It has manufactured tubes specifically designed for use in the underwater pipeline infrastructure of “Deep Sea No.1”, China’s first-ever ultra-deepwater high-pressure gas field development project. Overall, CITIC owns four specialised and sophisticated “little giant” enterprises, 20 specialised and sophisticated enterprises and 24 national high-tech enterprises.

2.Continuously improving the resilience of the industrial chain: CITIC Metal’s Kamoa-Kakula Copper Project in the Democratic Republic of Congo has maintained steady production and met production targets, retaining its leading position in the production of key non-ferrous metals for trading. The Sino Iron project has ensured the stable seaborne supply of magnetite concentrate for China, achieving a production volume of 10.41 million wet tonnes. Sino Iron remains the world’s largest seaborne supplier of magnetite concentrate to China. CITIC Resources has further improved production efficiency and asset value, yielding an equity oil production of 4.67 million barrels.

3.Contributing to better lives: CITIC Telecom International has a penetration rate of over 50% in the 5G market in Macau, supporting the city’s “Digital Macau 3.0” initiative. CITIC Press’s market share in the publishing sector has continued to grow, further solidifying its leading position in the industry. CITIC Environment won the bid for China’s largest seawater desalination project under construction. Dah Chong Hong has leveraged its strong channel network to expand its healthy snacks portfolio and identify business opportunities in the new energy vehicle market. CITIC Agriculture is working to build a leading enterprise in the seed industry, actively contributing to China’s development as an agricultural powerhouse.

4.Promoting globalised industrial development: Marking the 10th anniversary of the Belt and Road Initiative, we are strategically expanding our presence in key markets and advantageous sectors along the Belt and Road with the purpose of raising our global competitiveness. CITIC Dicastal’s aluminium casting parts manufacturing base in Morocco and aluminium wheels manufacturing base in Mexico have continuously strengthened their global competitiveness, with year-on-year increases in the sales of aluminium wheels and castings. CITIC Construction has made significant progress in the 20,000-unit Social Housing Project in Riyadh, Saudi Arabia, whilst the subway car project in Buenos Aires, Argentina, was successfully inspected and completed.

Back