CITIC Limited today announced its full-year results for the period ended 31 December 2023.

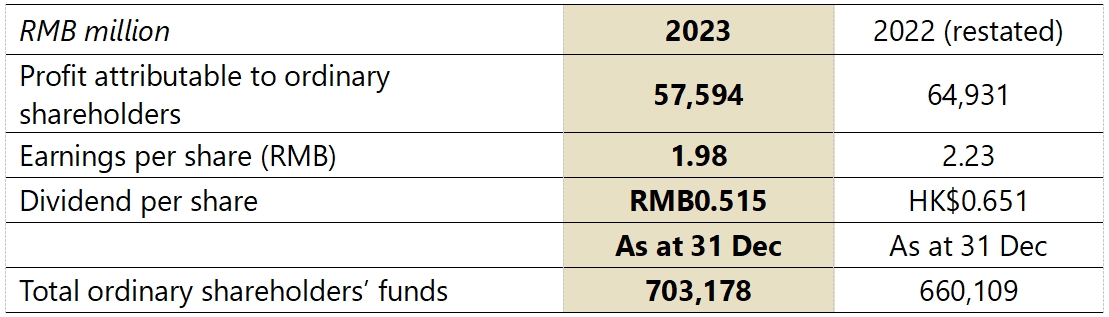

CITIC Limited's operating performance continued to outpace the broader market, with a profit attributable to ordinary shareholders of RMB57.594 billion for the year. This marks an increase of 5.4% on a comparable basis against 2022, after excluding a one-off revaluation gain of RMB10.3 billion from the consolidation of CITIC Securities. The Board recommends a final dividend of RMB0.335 per share, bringing the total dividend for 2023 to RMB0.515 per share. The total dividend payout ratio for the year is 26%, up by 0.9 percentage points from 2022.

1. Shouldering the mission to serve the greater good and resolutely acting on national strategic priorities

Coordinating subsidiaries to serve the real economy: By faithfully embracing the guiding principles set forth by the Central Financial Work Conference, we harnessed the strengths and capabilities of CITIC Financial Holdings and strictly complied with financial regulatory requirements. This enabled us to effectively prevent and defuse financial risks, and thereby contribute our unique strengths to the country’s path of financial development with Chinese characteristics. CITIC Financial Holdings improved its holistic management mechanism and optimised its integrated service models for strategic customers and “entrepreneur offices”, offering more comprehensive solutions better tailored to the real economy. CITIC Bank steadily improved its credit structure and increased financing support, leading to double-digit full-year growth in medium- and long-term loans for the manufacturing sector, loans for strategic emerging industries, inclusive finance and green finance. As leading brokerages, CITIC Securities and CSC Financial increased their proportion of direct financing. They completed equity and bond financing of RMB4 trillion during the year and supported the listing of 67 companies, retaining leading market shares in onshore equity and bond underwriting. CITIC Trust grew in scale, with expansion in low-risk segments including trust service and asset management trusts. CITIC-Prudential Life leveraged its unique advantages to provide long-term financial support in areas including infrastructure construction, development of small and medium-sized enterprises, and technological innovation.

Enhancing efficiency to ensure resource supply: The successful listing of CITIC Metal effectively facilitated the release of CITIC Limited’s intrinsic value. During the year, we leveraged the company’s strategic network of overseas resources. The KK Copper Mine in the Democratic Republic of the Congo produced a record high volume of over 390,000 tonnes. The Las Bambas Copper Mine in Peru successfully fulfilled its operational objectives by stabilising production and prioritising transport logistics. The Sino Iron project overcame challenges including labour shortages to produce over 20 million tonnes of concentrate for the fifth consecutive year.

Reinforcing industrial value chains to bolster resilience: CITIC Dicastal increased its global automotive parts manufacturing capacity with production bases in Morocco and Mexico operating at full capacity. It remained the global leader in aluminium wheel sales, embracing its brand aspiration of “Global Manufacturing, Global Service”. CITIC Heavy Industries provided key advanced equipment components for the country. It supported 17 consecutive launches of the Shenzhou spacecraft. It also provided critical forgings for nuclear power steam generators, which contributed to the commercial operation of the world's first fourth-generation nuclear power plant. CITIC Pacific Special Steel, through its control of Tianjin Pipe, greatly increased the competitiveness of its product range of bars, wires, tubes and plates. The acquisition of a controlling stake in Nanjing Iron & Steel further consolidated CITIC's leading position in the special steel industry. With a total annual production capacity of more than 30 million tonnes, this global specialty steel “aircraft carrier” continued its development voyage. CITIC Agriculture undertook major national projects and successfully passed its mid-term evaluation. Its research and development capabilities for high-quality crop varieties continued to improve. CITIC Agriculture also worked with Huawei to launch an open-source HarmonyOS for the agricultural industry, improving the quality and efficiency of the value chain.

Fostering open cooperation through the Belt and Road Initiative: CITIC Construction’s major projects, including the Belarusian agro-industrial complex project, progressed steadily while the East-West Highway in Algeria was fully commissioned. Apart from undertaking high-quality landmark projects, CITIC also focused on other fields such as education and training, agricultural cooperation, environmental protection, and health and sanitation. During the year, we rolled out a series of “small and beautiful” projects, including CITIC Dicastal’s High-tech Talent Special Training Camp in Morocco, CITIC Agriculture’s assistance to the seed industry and CITIC Environment’s water plants in Indonesia. These initiatives successfully reinforced a positive image for Chinese enterprises overseas.

2. Benchmarking against the best-in-class to drive reform and unleash corporate vitality

Improved quality and quantity of R&D: In 2023, the company established a science and technology association to further improve the scientific and technological innovation work system. Key progress has been made in many areas, such as tackling “bottleneck” technologies and exploring an enterprise-led, collaborative innovation consortium between industries, universities and research institutes. CITIC Holdings formed a partnership with Pengcheng Laboratory and was incorporated into its "network nodes", with the objective of addressing technological issues with the intelligent control of large equipment. We also participated in the development and manufacturing of bearings for high-speed rail bogies, which achieved positive results during rigorous track testing. We also realised groundbreaking achievements in integrated die-casting technology, which has had a deep impact on manufacturing processes within the automotive industry. As of the end of 2023, CITIC owned 9,972 valid patents and 3,040 invention patents, showcasing our enhanced capacity for independent innovation.

Achieving multiple breakthroughs in digital transformation: CITIC Limited formulated a digital transformation action plan, advanced cloud-based management and launched five flagship projects such as Finance Digitalisation 2.0. We also implemented several initiatives, including organising the first “Blooming Cup”, a digital application contest to stimulate innovation and potential within our subsidiaries. Our digital innovations won 54 provincial and ministerial-level awards in 2023 and many were showcased at the World Artificial Intelligence Conference in Shanghai. Xingcheng Special Steel, a member of CITIC Pacific Special Steel, was also recognised as the first “Factory Lighthouse” in the global special steel industry. This is the second CITIC manufacturing plant to receive this significant honour.

Driving synergy within our organisation: In 2023, the scale of synergy and collaboration amongst our financial subsidiaries continued to increase with the total value of cross-selling exceeding RMB2.1 trillion. The account opening rate at CITIC Bank for IPO clients of CITIC Securities and CSC Financial increased by 10% to 75%. We have also advanced the synergy between our industry and financial businesses and are exploring the integration of pension and insurance services, as well as further cooperation between CITIC Bank and other subsidiaries. Currently, 96% of our subsidiaries pay employee salaries through CITIC Bank which also covers 99% of individual pension accounts in regional pilot subsidiaries. Further increasing our “circle of friends”, we have expanded our network of partners, supporting subsidiaries in their market expansion efforts and have signed 13 new strategic customers, including a joint innovation centre with Huawei to explore new avenues of mutually beneficial cooperation.

Enhancing and upgrading the quality of special projects: We have advanced our efforts in “Creating New Revenue Streams and Tightening Expenses” as well as “Optimising Cost and Boosting Efficiency” and adopted a five-dimensional mechanism to increase the efficiency of synergy, innovation, technology, lean practices and shared development. To refine our management across employees, businesses and processes, our financial subsidiaries are actively reducing capital consumption. On the back of our successful completion of Fund Concentration 3.0, we advanced our treasury management by implementing reform plans in areas including fund budgeting, accounts receivable management and controls, and the next level of progress, Fund Concentration 3.0+.

Delivering strong results in ESG management: In 2023, CITIC made progress in working towards our dual carbon goals. We validated our carbon emission data and prepared a carbon profit and loss statement. Our total carbon emission intensity has dropped significantly and accelerated our green transformation. Moreover, we strengthened our ESG management system and formulated guidelines for ESG initiatives. CITIC Limited’s MSCI ESG rating has returned to the BBB level, with the highest score to date.

3. Overcoming difficulties, mitigating risks and building a solid line of defence for safe development

Coordinating and promoting collaborative risk management: We adhere to bottom-line thinking, effectively containing incremental risks to protect the company’s stability and longevity. We have improved our collaborative risk management mechanisms and created innovative methods for risk management between industrial and financial subsidiaries, as well as among financial subsidiaries. CITIC Bank, CITIC Financial Asset Management, CITIC Trust, CITIC Urban Development & Operation, and other subsidiaries have jointly resolved a number of higher-risk projects, resulting in an overall decline in the non-performing ratio of financial subsidiaries and effective conservation of core Tier 1 capital. We also actively supported local governments to ensure the delivery of housing projects, safeguarding public welfare and supporting the resumption of key projects. These efforts have strengthened our reputation and were well received by our communities.

Back